Ct Real Estate Tax Exemptions . Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. the four types of mechanisms are: For estates of decedents dying during 2024, the connecticut estate tax. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program.

from www.youtube.com

the four types of mechanisms are: Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. veterans exemption tax relief program. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. For estates of decedents dying during 2024, the connecticut estate tax.

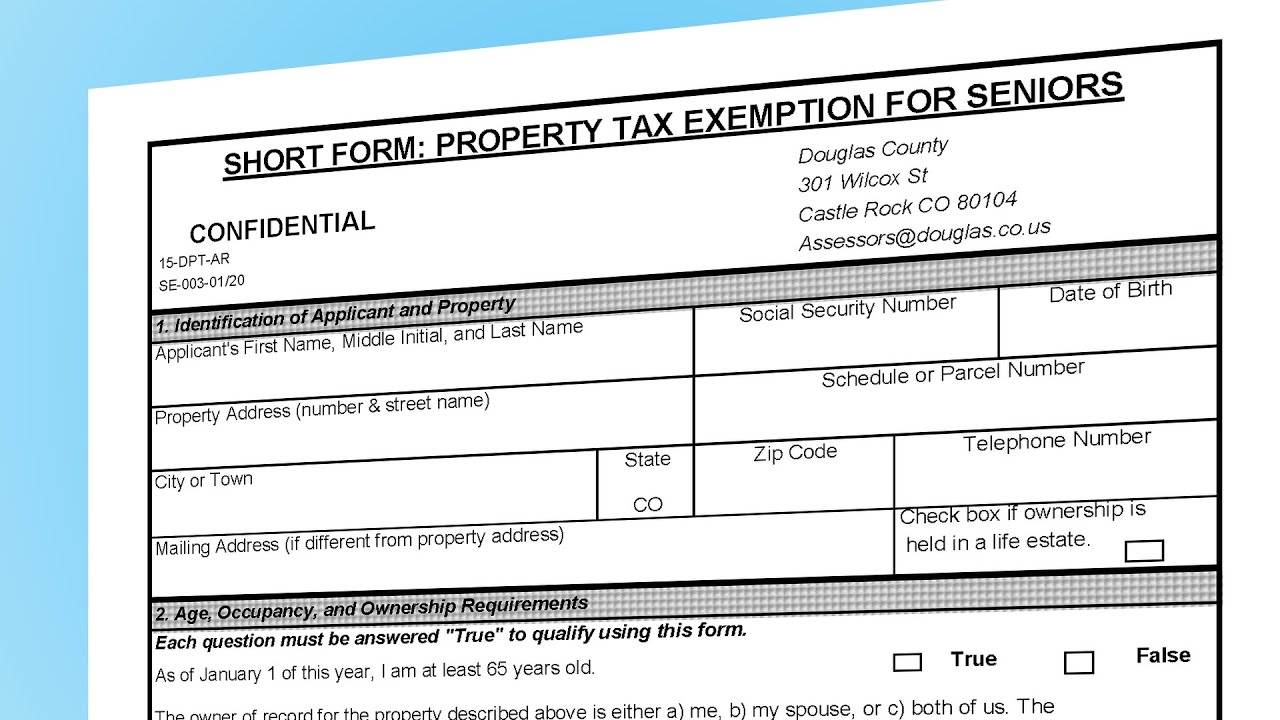

Property Tax Exemptions for Seniors and Veterans YouTube

Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. the four types of mechanisms are: State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. For estates of decedents dying during 2024, the connecticut estate tax.

From www.lendingtree.com

What Is a Homestead Exemption and How Does It Work? LendingTree Ct Real Estate Tax Exemptions state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. For estates of decedents dying during 2024, the connecticut estate tax. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. Homestead exemptions and credits, circuit breakers, tax freezes, and. Ct Real Estate Tax Exemptions.

From ponasa.condesan-ecoandes.org

Estate Tax Exemption Chart Ponasa Ct Real Estate Tax Exemptions state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. the four. Ct Real Estate Tax Exemptions.

From islandstaxinformation.blogspot.com

When Will Estate Tax Exemption Sunset Ct Real Estate Tax Exemptions the four types of mechanisms are: veterans exemption tax relief program. For estates of decedents dying during 2024, the connecticut estate tax. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. state law authorizes various property. Ct Real Estate Tax Exemptions.

From www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates Ct Real Estate Tax Exemptions Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. the four types of mechanisms are: For estates of decedents dying during 2024, the connecticut estate tax. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. State law provides a basic $1,000 property tax exemption for. Ct Real Estate Tax Exemptions.

From www.bpslawyers.com

What is Connecticut’s current estate tax exemption level? Brown Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. the four types of mechanisms are: Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. For estates of decedents dying during 2024, the connecticut estate tax. state law authorizes various property tax exemptions for connecticut residents, some. Ct Real Estate Tax Exemptions.

From pearlewhalli.pages.dev

Federal Exemption Estate Tax 2024 Emili Inesita Ct Real Estate Tax Exemptions Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. For estates of decedents dying during 2024, the connecticut estate tax. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city. Ct Real Estate Tax Exemptions.

From jcauaeaudit.com

CT Exemption Norms for Real Estate Investment Trusts Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program. For estates of decedents dying during 2024, the connecticut estate tax. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. the four types of mechanisms are: state law authorizes various property. Ct Real Estate Tax Exemptions.

From kialqxylina.pages.dev

Ct Estate Tax Exemption 2024 Alanah Teresa Ct Real Estate Tax Exemptions state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. the four types of mechanisms are: State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program. For estates of decedents dying during 2024,. Ct Real Estate Tax Exemptions.

From www.formsbank.com

Top 60 Ct Tax Exempt Form Templates free to download in PDF format Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program. For estates of decedents dying during 2024, the connecticut estate tax. the four types of mechanisms are: state law authorizes various property tax exemptions for connecticut residents, some of which are available in. Ct Real Estate Tax Exemptions.

From kialqxylina.pages.dev

Ct Estate Tax Exemption 2024 Alanah Teresa Ct Real Estate Tax Exemptions state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. For estates of decedents dying during 2024, the connecticut estate tax. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. veterans exemption tax relief program. State law provides a basic $1,000 property tax exemption for certain. Ct Real Estate Tax Exemptions.

From ponasa.condesan-ecoandes.org

Estate Tax Exemption Chart Ponasa Ct Real Estate Tax Exemptions For estates of decedents dying during 2024, the connecticut estate tax. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. veterans exemption tax relief program. the four types of mechanisms are: Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. State law provides a. Ct Real Estate Tax Exemptions.

From www.amybergquist.com

Calculating West Hartford Property Taxes for July 2022 to June 2023 Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. the four. Ct Real Estate Tax Exemptions.

From www.topqueensagent.com

Available Real Estate Tax Exemptions Manuel Vargas Top Queens Agent Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. For estates of decedents dying during 2024, the connecticut estate tax. the four types of mechanisms are: Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. state law authorizes various property tax exemptions for connecticut residents, some. Ct Real Estate Tax Exemptions.

From www.formsbank.com

Fillable Application For Real Estate Tax Exemption Or Deferral And/or Ct Real Estate Tax Exemptions the four types of mechanisms are: Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. For estates of decedents dying during 2024, the connecticut estate tax. State law provides a basic $1,000 property tax exemption for. Ct Real Estate Tax Exemptions.

From www.youtube.com

Property Tax Exemptions for Seniors and Veterans YouTube Ct Real Estate Tax Exemptions Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. For estates of decedents dying during 2024, the connecticut estate tax. veterans exemption tax relief program. the four types of mechanisms are: state law authorizes various property. Ct Real Estate Tax Exemptions.

From usrealestateinsider.com

Exemptions in Property Tax Explained Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. veterans exemption tax relief program. the four types of mechanisms are: For estates of decedents dying during 2024, the connecticut estate tax. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. state law authorizes various property. Ct Real Estate Tax Exemptions.

From usrealestateinsider.com

Exemptions in Property Tax Explained Ct Real Estate Tax Exemptions state law authorizes various property tax exemptions for connecticut residents, some of which are available in every city and town. State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. the four types of mechanisms are: Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. For estates. Ct Real Estate Tax Exemptions.

From www.hartfordbusiness.com

CT tax exemptions, deductions, credits total 7B Hartford Business Ct Real Estate Tax Exemptions State law provides a basic $1,000 property tax exemption for certain honorably discharged veterans who actively served at least. Homestead exemptions and credits, circuit breakers, tax freezes, and tax deferrals. For estates of decedents dying during 2024, the connecticut estate tax. veterans exemption tax relief program. state law authorizes various property tax exemptions for connecticut residents, some of. Ct Real Estate Tax Exemptions.